Questions Considered

- How was our area affected by the decline in the housing market?

- Has the housing market in our area recovered? Is there a “new normal”?

- Are distressed sales (short sales, foreclosures and bank-owned properties) still significant?

Data Analyzed

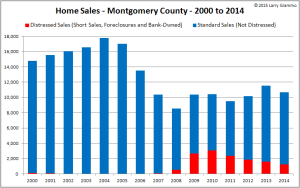

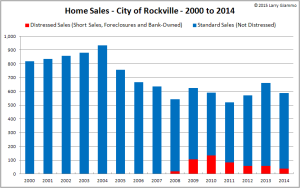

- Montgomery County and the City of Rockville (i.e. within the city limits)

- Annual volume of home sales, for all types of housing, from 2000 to 2014

- Differentiated between “distressed” and “standard” sales

- Data source: MRIS (our area’s multiple listing service)

Results of Analysis (click on the graphs above to enlarge)

- Volumes peaked in 2004 then dropped significantly through 2008. In 2008, the bottom of the market, the number of home sales compared to 2004 was:

- 42% lower in Montgomery County

- 34% lower in the City of Rockville

- Since 2008, the market appears to have stabilized and has been gradually rebounding, albeit unevenly on a year-over-year basis. The number of home sales in 2014 compared to 2008 was:

- 25% higher in Montgomery County

- 8% higher in the City of Rockville

- Distressed sales (short sales, foreclosures and bank-owned properties), a very significant part of the market in 2009 through 2011, continue to be a factor, although in decreasing quantities.

Distressed Sales as a Percentage of Total Home Sales

Montgomery County and City of Rockville, 2007 – 2014

| Year | Montgomery County |

City of Rockville |

|---|---|---|

| 2007 | 0.6% | 0.5% |

| 2008 | 6.1% | 3.5% |

| 2009 | 25.5% | 17.0% |

| 2010 | 29.5% | 22.5% |

| 2011 | 24.8% | 15.8% |

| 2012 | 18.0% | 10.2% |

| 2013 | 13.7% | 8.9% |

| 2014 | 11.7% | 6.3% |

Insights & Conclusions

- It is unlikely the housing market will reach early-2000’s levels, at least for the foreseeable future. The data presented here corroborates the conclusion that we were indeed in a real estate bubble in the early-2000’s, with sales volumes and prices driven by speculation and fueled by questionable, lax loan practices.

- The good news, based on this and other data, is that the housing market in our area appears to have stabilized and has been gradually rebounding from the lows seen in 2008.

- It is especially promising to see the volume of distressed sales continuing to decline. These sales can have a significant negative effect on the market by depressing prices and, as a result, keeping potential sellers out of the market. If the current economic recovery continues, it seems reasonable to expect the number of distressed sales to continue to decline.

- A cautionary note: The recovery in the housing market appears to be uneven and may be fragile. Interest rates remain near historic lows which obviously helps bolster the demand side of the housing market. A significant climb in interest rates, if it were to occur, would likely stall or potentially begin to reverse the continuing recovery in the housing market.

- A further thought: In upcoming blog posts, I’ll highlight why it is important to look at relevant sub-markets rather than the wider market when considering the sale or purchase of any specific property. For example, I recently did an analysis for a prospective home seller in the City of Rockville where I specifically analyzed sales of single family homes between 2,500 and 3,500 square feet within the city limits. This particular sub-market, for instance, is somewhat stronger at this time, by all measures, than the housing market in Rockville generally.