Zillow estimates the value on every property in their database. Their branded name for this valuation is a “Zestimate.” Many people use Zestimates. And, some people believe Zestimates are unquestionable. But, are they actually accurate? And, should they be relied upon?

What Zillow Says

Zillow provides an overview of their methodology and repeatedly indicates that a Zestimate is only a “starting point” for valuing a property and “should not be used to value a home.”

Zillow’s information about Zestimates is found here: http://www.zillow.com/zestimate/.

Zillow acknowledges the major short-coming of their automated methodology – Zillow doesn’t know many of the salient details for any property, like the overall condition of the property, whether it’s been updated, anything about any special or unique features, etc. All Zillow knows is the square footage of the house (which might not be accurate, by the way), the number of bedrooms and bathrooms, the size of the lot, and a few other bits of data.

This is the same reason that property tax assessments are inaccurate. Most assessment agencies similarly use an automated valuation process which, like Zillow’s, is based on broad averaging of property sales across wide geographic areas, using limited property-specific data.

Error Rates and Implications

Zillow discloses that the median error for Zestimates nationally is approximately 8% (meaning half of all properties are either over- or under-valued by more than 8%). And, nearly 20% of properties are over- or under-valued by more than 20%. These error rates are very significant.

A difference of just a few percent can have big implications if you’re, say, selling a property. If you set the price too low, you’ll potentially leave money on the table. Too high, and your property might sit on the market for weeks, if not months, longer than it would have had it been priced appropriately. Whether you’re selling or buying a property, there’s too much at stake financially to be relying on estimates of value that are likely off by 5%, 10%, or even 20% or more.

See my blog post: https://www.larrygiammo.com/2015/01/08/why-setting-the-right-price-matters/.

Inaccuracy Isn’t the Only Issue

I’ve also found, through direct experience, that Zillow’s Zestimates can fluctuate wildly for the same property AND the Zestimate for a property appears to be at least partially driven by the property’s status (i.e., not for sale, for sale, under contract or recently sold).

Case in point: My own property in Pasadena, MD. It’s located on the Magothy River in Anne Arundel County. In August of 2014, I signed up to receive Zestimate updates via email from Zillow. We subsequently initially put the property on the market in October 2014 and ultimately sold the property in October 2015.

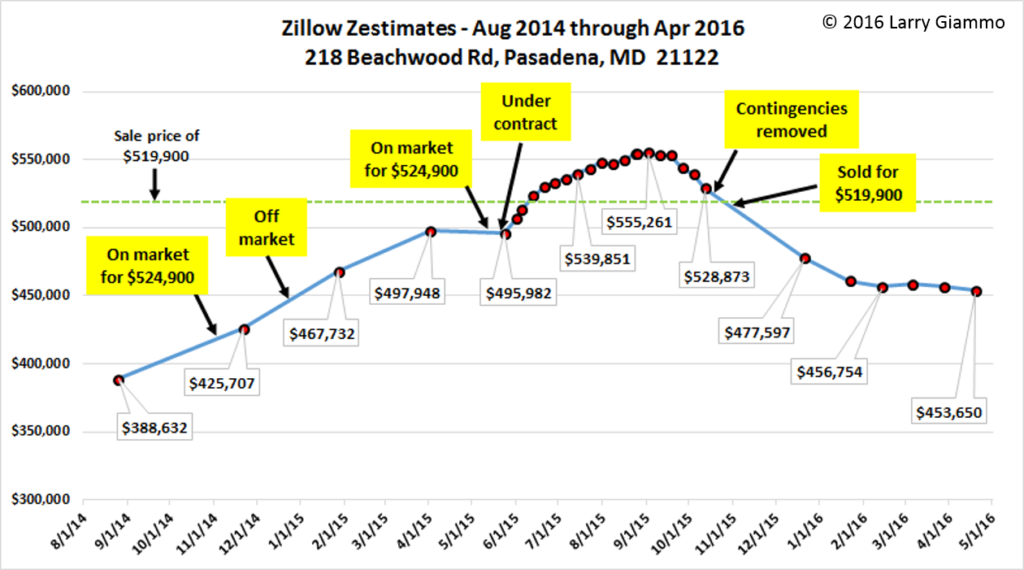

Below, you can see how the Zestimate changed across that time, in relation to the timeline for selling the house. Each red dot represents a Zestimate update I received via email from Zillow.

Case Example Observations & Insights

- Overall, across the 21 months, the Zestimate started at $388,632, peaked at $555,261, then declined to $453,650. That’s a 43% increase from the first Zestimate to the peak, then an 18% decline from the peak to the last Zestimate in April 2016. That’s a staggeringly large range.

- The frequency of updates increased dramatically, to basically one per week, during the time the house was under contract but before all contingencies had been removed (each red dot is an emailed Zestimate update I received). And, there was a sharp rise in the Zestimate across the first month after the house went under contract. Is Zillow trying to influence the transaction?

- The last Zestimate update before settlement was $528,873. The first Zestimate update after settlement occurred was $477, 597, a drop of nearly 10%. Why the steep drop?

- Six months after settlement, the Zestimate had dropped to $453,650. That’s $66,250, or nearly 13%, less than the actual sale price of $519,900. Why is the sale price essentially ignored?

This one case study alone is enough to shatter any confidence I might have had in the accuracy – or the usefulness – of Zestimates. If anything, I’d strongly suggest against relying on Zestimates to inform any decision on the pricing of a property you want to sell or to make an offer on.